| |

Flight From Inflation

The Monetary Alternative

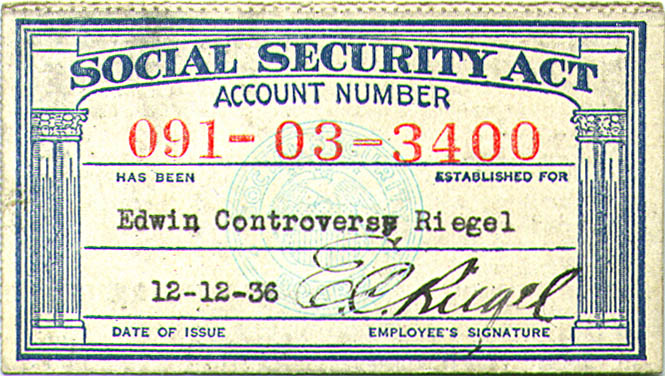

by E. C. Riegel

Edited by Spencer Heath MacCallum and George Morton

THE HEATHER FOUNDATION

Los Angeles California

Copyright © 2003 The Heather Foundation

Table of Contents

Editorial Preface

Introduction

Chapter 1 Storm Winds of Inflation

Chapter 2 A Monetary Rationale

Chapter 3 Banking and Business Cycles

Chapter 4 Legal Counterfeit

Chapter 5 The Hazard Ahead

Chapter 6 Toward a Natural Monetary system

Chapter 7 Credit and Banking Under Monetary Freedom

Chapter 8 Omnibus Reform

Chapter 9 Economic Democracy

Chapter 10 New Vistas

Essay 1 What Do You Mean By "Dollars?"

Essay 2 Credit Limits Under the Valun System

Essay 3 Relativity of Values

Essay 4 The Future of Gold

Essay 5 Manarchy

Correspondence

Index

E.C. Riegel's major work, published for the first time, containing the definitive exposition of his monetary ideas supplemented with five essays and selections from his correspondence.

Concise and prophetic, this book exceeds by far the conventional limits of the discussion of money. With respect to inflation, it points out that there have been many inflations of national monetary units, but that in the past there always remained a single relatively stable unit, the pound in the 19th century and the dollar in the 20th, to which holders of vanishing units could take flight. This became the unit of account, enabling businesses to survive the extinction of their national unit.

What we are now experiencing, however, for the first time in history, is a global inflation with all of the national monetary units sliding into the sea. Riegel explains clearly the origins of the present world inflation and how a nonpolitical monetary unit and system might be constructed before the world business community suffers a collapse. He offers specific guidelines for such a unit and system, which would evolve competitively and not await political sanction or require political measures.

One April morning in 1954, a monetary thinker and inflation counselor, considered a genius and a prophet by those few who knew him and his ideas, died obscurely of Parkinson's disease. He was 75 years old. Only a few intimates knew that he had devoted the last years of his life, painfully because of his growing affliction, to writing a major book on the global inflation he saw ahead and its consequences for civilization. He lived long enough to completely draft the manuscript, then died. For all practical purposes, the manuscript was lost with his death. More than twenty years passed before it was discovered, accidentally, by persons unaware of its existence. Ironically, this may have been the best thing that could have happened to the book. Far from being hurt by its dormancy, it was as if the book had aged like fine wine-except that it was the world, not the book, that had changed. Riegel's thesis was so far advanced for its time that no publisher in the 1950s would have believed it or considered it seriously. Today, it is quite another story. World events have proven the prophetic quality of the book and its relevance to the growing monetary crisis. At a time when, instead of inquiring into the nature of money and its role in exchange, everyone is trying to apply stop-gap remedies, this book provokes its reader to stop and change mental gears and begin to think fundamentally for perhaps the first time about money. This profound virtue of the book is sorely needed.

Riegel's writing is readable, profound and relevant. He gives a clear analysis for the thoughtful layman of the underlying causes of the world monetary crisis and of the possibilities and probabilities before us. The reader will understand why Riegel predicted, fully ten years before his death, the present global inflation, and why he believed it would continue until the dollar slides completely into the sea. This book sets out with rare clarity the basis of Riegel's thinking; the reader can judge for himself the validity of his conclusions.

Spencer H. MacCallum

| |

|